Now Reading: Tech Layoffs 2025: Comprehensive Tracker & Analysis of Industry Cuts

-

01

Tech Layoffs 2025: Comprehensive Tracker & Analysis of Industry Cuts

Tech Layoffs 2025: Comprehensive Tracker & Analysis of Industry Cuts

Table of Contents

The tech landscape in 2025 is marked by a paradoxical tension: innovation is booming, fueled by advancements in AI, while at the same time, thousands of tech workers face uncertainty as companies grapple with economic pressures and shifting business models. This analysis explores the complexities of Tech Layoffs 2025, examining their impact on the workforce, the industry, and the future of technology.

Tracking the Tide: A Comprehensive Analysis of Tech Layoffs 2025

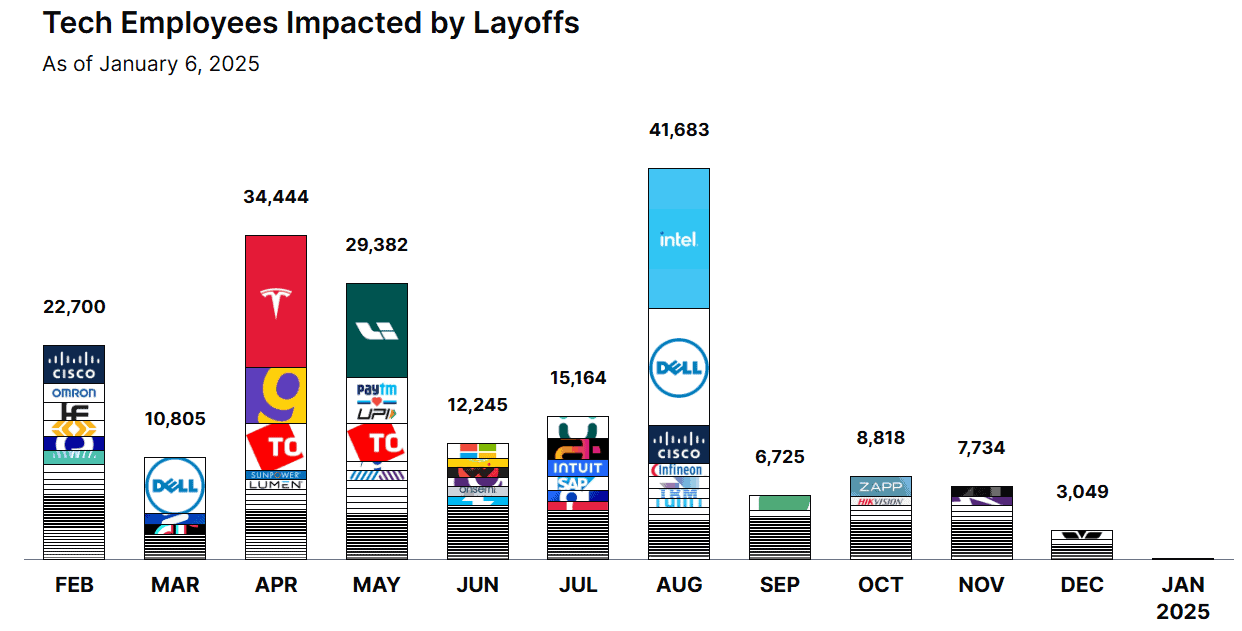

The significant wave of job cuts that swept through the technology sector in previous years shows few signs of receding in 2025. Contrary to hopes for stabilization, the industry continues to undergo substantial workforce adjustments. Following a year where over 150,000 tech jobs were eliminated across more than 500 companies (according to Layoffs.fyi data for 2024), the trend persists. As of early April 2025, data indicates that more than 22,000 tech workers have already faced layoffs this year alone, with February proving particularly brutal, witnessing over 16,000 cuts.

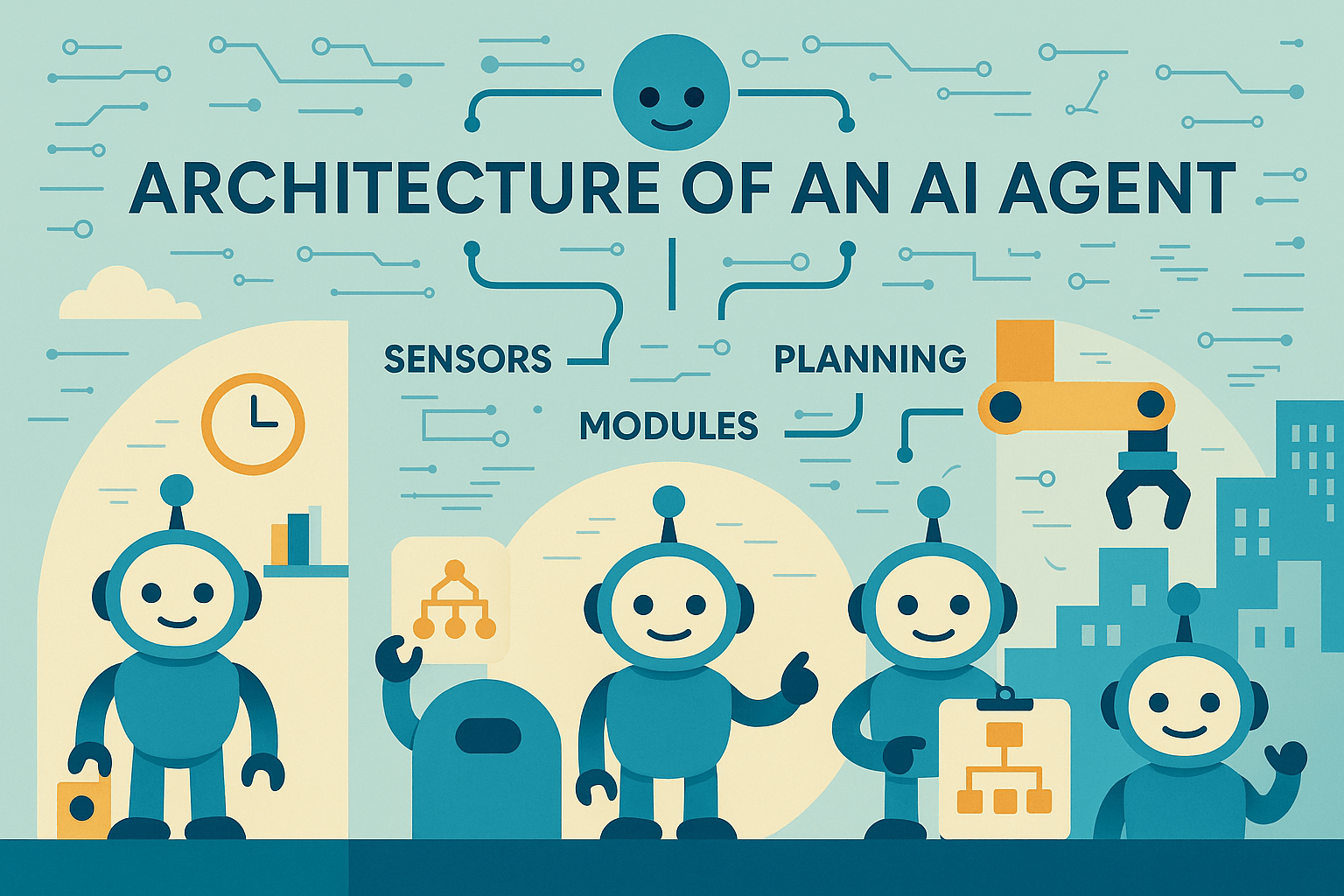

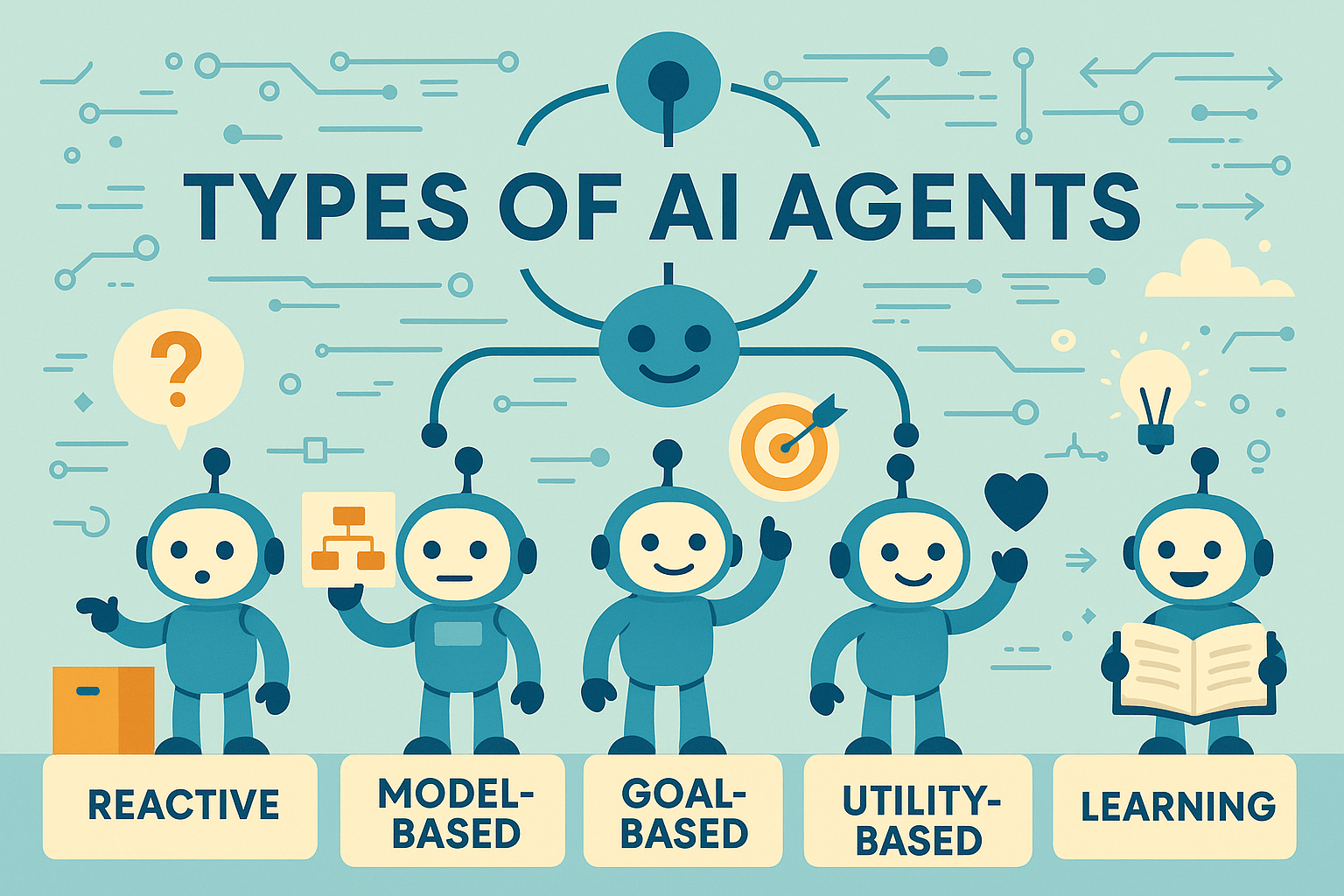

This ongoing recalibration impacts companies of all sizes and types, from global giants refining their strategies to startups navigating harsh economic realities. The drivers are multifaceted, involving continued economic pressures, strategic realignments, the pervasive influence of Artificial Intelligence (AI) and automation, and shifts in market dynamics. This article provides a comprehensive tracker of known Tech Layoffs 2025, analyzing the patterns and highlighting the human element amidst relentless innovation.

The Scale of Early 2025 Reductions: A Statistical Overview

The year began with a continuation of workforce adjustments, quickly escalating in scale:

- January 2025: Started the year with over 2,403 documented tech job losses.

- February 2025: Saw a dramatic surge, with 16,234 employees laid off across various tech firms. This spike indicated an acceleration of restructuring and cost-cutting measures early in the year.

- March 2025: While specific aggregated tech numbers require careful tracking, the month saw numerous significant announcements continuing the trend (the source article mentions a large number potentially including other sectors or cumulative data, emphasizing the need for ongoing tracking).

- April 2025: The month has already started with notable cuts, signaling that the trend is far from over.

Cumulatively, the loss of over 22,000 tech jobs in just the first quarter underscores the significant pressure the industry faces. This tracker serves not only as a log of events but also as a lens through which to understand the broader forces reshaping the tech landscape.

Key Drivers: Why Are Tech Companies Cutting Jobs in 2025?

While each company has its unique context, several overarching themes emerge from the tech layoffs 2025 announcements:

1. Strategic Restructuring & Efficiency Drives: Many companies are streamlining operations, consolidating divisions, or refocusing on core priorities. This often involves “flattening” organizational structures and optimizing for profitability. Examples include:

- Block: Cut 8% (931 employees) in a reorganization explicitly stated not to be financial or AI-replacement driven by CEO Jack Dorsey.

- Siemens: Plans global cuts (approx. 5,600) in automation and EV charging to boost competitiveness.

- Wayfair: Cut 340 in its tech division (March) and planned 730 cuts related to exiting Germany (January).

- HPE: Reducing staff by 5% (2,500 jobs) following a share price drop.

- Autodesk: Laying off 9% (1,350 employees) to reshape its go-to-market model and reduce facilities footprint.

- Google: Reorganizing People Operations and cloud teams, offering voluntary exits.

- Starbucks: Cut 1,100 jobs, including tech roles, opting to outsource some tech work.

- LiveRamp, Dayforce, SolarEdge, Aqua Security, Textio, Icon: All cited restructuring, efficiency, or realignment as reasons for cuts.

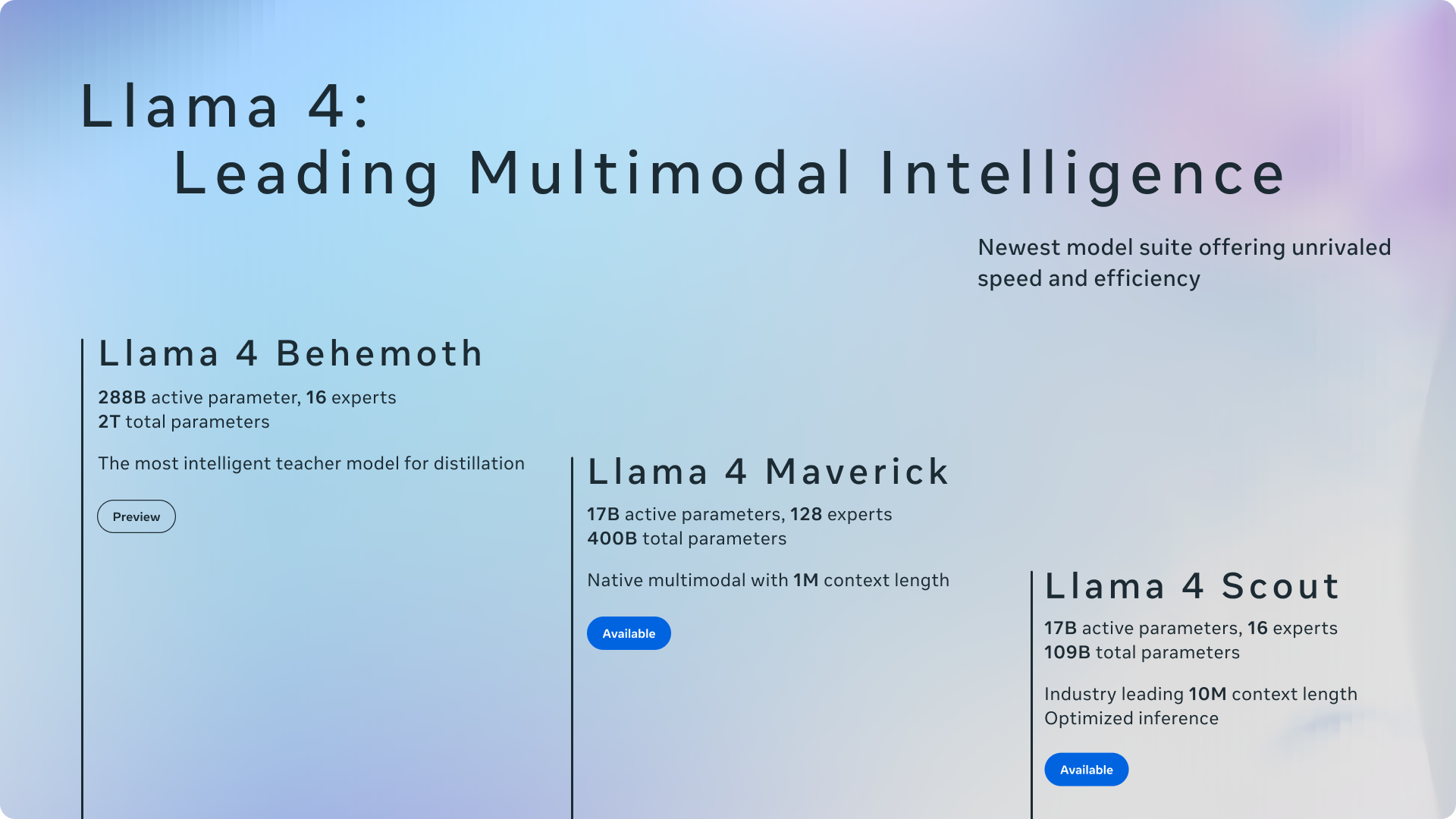

2. The AI & Automation Factor: AI’s rapid advancement is a double-edged sword. While driving innovation and hiring in specialized areas, it’s also enabling automation and prompting strategic shifts:

- Automattic (WordPress, Tumblr): Laying off 16% (over 270 staff) across departments.

- Canva: Let go of technical writers months after encouraging generative AI tool usage internally.

- Salesforce: Eliminating over 1,000 jobs even while actively hiring for new AI product roles.

- NASA: Shutting down policy and DEI offices related to broader strategic shifts potentially influenced by external directives (referenced as “DOGE”).

3. Market Conditions, Financial Performance & Post-Acquisition Adjustments: Economic uncertainty, pressure to achieve profitability, industry downturns, and post-merger integrations are major contributors:

- Northvolt: Massive layoff (2,800 employees, 62% of staff) following bankruptcy filing.

- Brightcove: Cut two-thirds of its U.S. workforce (198 employees) a month after being acquired by Bending Spoons.

- Acxiom: Laid off 3.5% (130 employees) amidst a potential parent company merger (IPG & Omnicom).

- HelloFresh: Closing a distribution center (273 layoffs) to consolidate regional operations.

- GrubHub: Cut over 20% (500 jobs) after being sold to Wonder Group.

- Commercetools: Laid off staff (around 10%) after missing sales growth targets.

- Expedia: Continued cost-cutting layoffs following previous reductions.

- Skybox Security: Ceased operations and laid off ~300 staff after selling its business to Tufin.

- Sophos: Cut 6% shortly after acquiring Secureworks.

- Sprinklr: Let go 15% (about 500 employees), citing poor business performance after previous rounds.

- Workday: Significant cut of 8.5% (1,750 employees).

- Okta: Laid off 180 employees, following cuts the previous year.

- Cruise: Shutting down, laying off 50%, including top executives, with remnants moving to GM.

- Placer.ai, Aurora Solar, SolarEdge: Cited profitability goals or macroeconomic/industry challenges.

4. Startup Ecosystem Pressures & Closures: Startups face unique challenges related to funding, market fit, and scaling:

- Otorio: Cut over half its workforce (45 employees) after being acquired by Armis.

- ActiveFence: Reduced staff by 7% (22 employees) during a streamlining process.

- D-ID: Cut nearly 25% (22 jobs) following a strategic partnership announcement with Microsoft.

- Nautilus: Reduced headcount by 16% (25 employees) years ahead of planned commercial release.

- Rec Room: Cut 16% to become “scrappier” and “more efficient.”

- ANS Commerce: Shut down three years after acquisition by Flipkart.

- HerMD: Shutting down operations amid healthcare sector challenges despite recent funding.

- Vendease: Cut 44% (120 employees) in its second round within five months.

- Logically: Layoffs aimed at ensuring “long-term success” in curbing misinformation.

- Blue Origin: Significant layoff (over 1,000 employees, ~10%) impacting engineering and program management.

- Zepz: Cutting nearly 200 employees, closing operations in Poland and Kenya.

- JustWorks: Cut nearly 200 employees citing potential adverse economic events.

- Bird: Cut one-third of staff (120 jobs) just a year after a previous round and rebrand.

- Cushion, Pandion, Level: Fintech and delivery startups shutting down operations entirely.

A Month-by-Month Look at Notable 2025 Tech Layoffs

The provided list details specific company actions chronologically:

April:

- Automattic: A significant 16% cut (~270+ staff) impacting the WordPress/Tumblr developer.

- Canva: Targeted layoffs of technical writers following an internal push for AI tool adoption.

March: A month marked by large-scale tech layoffs and diverse reasons:

- Major Events: Northvolt (bankruptcy, 2,800 jobs), Block (reorg, 931 jobs), Siemens (competitiveness, 5,600 jobs), HPE (shares, 2,500 jobs).

- Post-Acquisition/Merger Context: Brightcove (198 jobs), Acxiom (130 jobs), Otorio (45 jobs).

- Restructuring/Consolidation: HelloFresh (273 jobs), Wayfair (tech division, 340 jobs), TikTok (Dublin office, ~300 jobs), LiveRamp (65 jobs), Ola Electric (1,000+), Rec Room (16%), ActiveFence (22 jobs).

- Strategic Shifts/Closures: Sequoia Capital (D.C. policy office), D-ID (post-Microsoft partnership, 22 jobs), NASA (office closures), ANS Commerce (shutdown).

- Unconfirmed: Zonar Systems.

February: The peak month so far, characterized by numerous significant cuts:

- Large Scale & Restructuring: HP (up to 2,000 jobs), Autodesk (1,350 jobs), Google (reorg), Blue Origin (~1,000 jobs), Redfin (450 jobs planned), Workday (1,750 jobs), Salesforce (1,000+ jobs).

- Post-Sale/Acquisition: GrubHub (500 jobs), Sophos (6%).

- Performance/Efficiency: Commercetools (dozens), Dayforce (5%), Expedia (unknown number), Sprinklr (500 jobs), Sonos (~200 jobs).

- Startup Challenges/Closures: Skybox Security (~300 jobs, shutdown), HerMD (shutdown), Vendease (120 jobs), Bird (120 jobs).

- Other Notable Cuts: Nautilus (25 jobs), eBay (Israel office, dozens), Starbucks (1,100 jobs, tech outsourcing), Zendesk (51 jobs, SF HQ), Logically (dozens), Zepz (~200 jobs), Unity (unknown number), JustWorks (~200 jobs), Okta (180 jobs).

January: Setting the stage for the year with closures and strategic cuts:

- Shutdowns: Cushion, Pandion (63 jobs), Level.

- Restructuring/Profitability: Placer.ai (150 jobs), Amazon (comms dept, dozens), Stripe (300 jobs, despite growth plans), Textio (15 employees), Pocket FM (75 employees), Aurora Solar (58 jobs), Meta (5% “low performers”), Wayfair (730 jobs, Germany exit), Icon (114 jobs, realignment), Altruist (37 jobs), Aqua Security (dozens), SolarEdge (400 jobs).

(Suggested Image Placement: Perhaps small, standardized logos next to key company mentions in the monthly summaries, if formatting allows.)

The Human Dimension and Industry Outlook

Behind every number is an individual navigating career disruption. The constant stream of Tech Layoffs 2025 creates a challenging environment:

- Increased Competition: The job market for tech talent becomes more saturated, making searches longer and more demanding.

- Skill Adaptation: Continuous learning and reskilling, particularly around AI, cloud technologies, and data analysis, become crucial for career resilience.

- Impact on Innovation: While some cuts aim to refocus resources on innovation (like AI), widespread reductions can also stifle experimentation and risk-taking due to fear and reduced capacity.

- Employee Morale: Remaining employees often face increased workloads and anxiety about future stability.

Looking ahead, the focus on efficiency, profitability, and strategic AI integration is likely to continue shaping workforce decisions. Mergers and acquisitions might increase as companies seek consolidation. Adaptability, specialized skills, and a clear understanding of business objectives will be key differentiators for tech professionals navigating this evolving landscape.

Conclusion: An Industry in Transformation

The narrative of Tech Layoffs 2025 is one of profound transformation. It’s more than just an economic downturn response; it reflects fundamental shifts driven by technological advancements like AI, maturing markets, and evolving investor expectations. While these adjustments bring hardship to many individuals, they are also forcing a critical re-evaluation of business models and priorities across the sector. Tracking these changes provides essential insights into the future direction of technology and the workforce that powers it. The resilience and adaptability of both companies and their employees will be paramount in navigating this dynamic period.